Legend has it that Sicily’s King Hiero of Syracuse once commissioned a new royal crown for himself, for which he provided an ample supply of solid gold for the goldsmith to use. When the finished crown arrived, the good king had suspicions that the goldsmith may have used only a portion of the gold provided, keeping the unused portion for himself and adding sterling silver to balance the crown to the correct weight.

To find out if this was true, the king turned to his jack of all trades, Archimedes – the Greek mathematician, physicist, engineer, inventor and astronomer – and asked him to determine whether or not the finished crown was in fact pure gold, without damaging the crown in the examination process.

Archimedes was perplexed by this task, but soon found inspiration in strangest of circumstances – while taking his evening bath. He astutely noticed that the bath water level overflowed as he lowered himself into it, which subsequently led to the discovery that he could simply measure the crown’s volume by the amount of water it displaced. He knew that since he could measure the crown’s volume, all he had to do was determine its weight in order to come up with its density, and hence its purity.

Archimedes was so exuberant about this monumental discovery that he sprinted stark naked through the streets of ancient Syracuse shouting, “Eureka! Eureka!” which in Greek translates to, “I’ve found it!”

Over the past year I’ve had many such “Eureka!” moments (though none big enough to get me sprinting unclothed through my neighborhood). And many of these discoveries relate to the sale or transfer of a client’s business. Here’s a sample of what I’ve found:

Eureka Moment #1: Unless you have the longevity of Moses, you will transfer your business at some point this century. The only question is, “How you will do it?” Most business owners think there is just a single method to transfer their business: Sell-out to the highest bidder. Unfortunately, not much planning goes into this sell-out decision. Sooner or later the owner decides he wants out, gets worn out with the process, and retains either a business broker or a mergers and acquisition (M&A) advisor. I’m here to tell you that there’s a better way to deal with such an important decision, my friend.

Eureka Moment #2: The marketplace for service providers is not in sync on the issue of business transfers. Business brokers and M&A advisors often share the same worldview, one that stipulates one option to offer, which is an outright sale of the business. I call these providers “sell the business hammers” because to them, every business looks like a big nail that needs to be hammered into a sale.

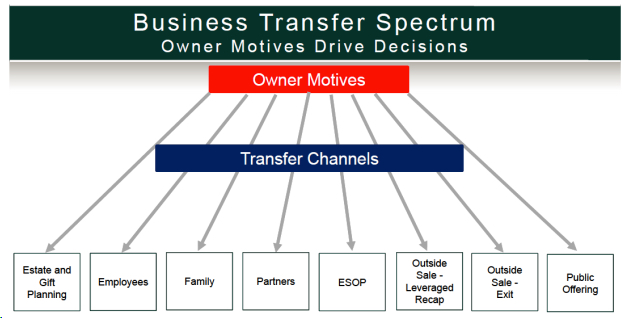

Eureka Moment #3: The first thing any business owner must do when considering a transfer transition is to get a clear picture of their reason(s) for transferring ownership. According to Rob Slee, author of a business book titled “Private Capital Markets,” owners have hundreds of choices by which they can transfer a private business or business interest. The key is to be aware of these choices and, more importantly, take time to carefully think through what is truly motivating you to consider a transfer.

Eureka Moment #4: Money is usually the one constant motive shared by owners and advisors. We all can agree money is important, however depending on the owner’s unique circumstances the importance of money can widely vary. And it’s usually not the only motivating factor in a transfer (in fact, it may not even be the most important factor). Other common motives are family priorities, employees, business legacy, community, and the owner’s role in the business post-transition.

Eureka Moment #5: Maintaining clarity about your reasons for wanting to transfer your business is important. An owner’s motive for a transfer leads to a decision on a transfer method, which is linked to a specific value world. Each value world utilizes a unique appraisal process which yields a specific value (not because I say so, but because an authority in each value world mandates it). Thus, an owner can plan the timing and value of their business in a transfer.

Eureka Moment #6: It’s important to understand that each of the options on the chart above comes with tradeoffs, or specific pros and cons associated with each choice. An awareness and understanding of all of these options is critical, but clarity of motives is what gives you the ability and the freedom to choose the correct strategy for your inevitable transition.

The moral of the story is this: As a business owner, there are myriad ways to transfer your business. Having total clarity and understanding about your ultimate motives is the first step to getting there.

# # #

Roger S. Balser is the Managing Partner of Balser Wealth Management, LLC leads the design and implementation of strategies to help business owners achieve and exceed their goals, both before and after they leave their business. He has more than 30 years of experience advising business owners and managing their business and non-business wealth.Balser Wealth Management, LLC, 36873 Harriman Trail Avon, OH 44011, 440-934-3114, roger@balserwealth.com, www.balserwealth.com