In this week’s edition of Two-Minute-Tuesday Roger gives his two-cents on the state of the markets.

How Are Your Investments Seeded?

How Are Your Investments Seeded?

The Spring daffodils poking their heads up is a clear sign the college basketball season is beginning to wind down and the celebrated NCAA Division I Men’s Basketball Tournament often nicknamed “March Madness” is right around the corner. People all over the country will be scrambling to fill out their brackets and cheer on their favorite teams.

For the uninitiated, the tournament begins with 68 teams and operates in a knockout format, concluding with just one team left standing after three emotion-filled Weeks and 67 exciting games.

It’s also the foundation for recreational office pools and bracket tournaments shared among friends and family. As these fun-loving participants fret over their brackets and debate which of their favorite teams has the talent to make it to the finals, included in everyone’s selection process is each team’s designated “seed” which shows where the team is ranked in their region and overall.

The NCAA began seeding teams in 1979 as a way to ensure that the strongest teams didn’t meet each other early in the tournament. The seeding also gives the average sports fan a starting point from which to make their picks as well.

Let’s not kid ourselves, no matter how diehard a basketball fan you are, you are also an attorney, and you don’t have time to follow 68 teams throughout the season. Further, you have no idea who those 68 teams are at the beginning of the season.

The Process

Selecting the teams you believe will advance in your bracket is biased. For instance, being born and raised in Northern Ohio I give preference to those teams in the Big Ten conference merely because those are the teams with which I am most familiar.

I can say with confidence that this is no way to make prudent investment decisions. I am not the most astute college basketball fan in the world, but I would consider myself to be somewhat knowledgeable in that arena. While the Big Ten is arguably the best overall conference in college basketball, having a “hometown” bias does not always improve one’s odds during “March Madness,” nor does it necessarily help one’s investment returns in the financial markets. The most sound investment decisions that I have ever made have been based completely on objective, (as opposed to subjective) information.

History of Games Won

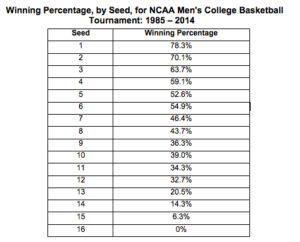

With this in mind I’ll share a few observations from analyzing the NCAA brackets for the past twenty-eight years to ascertain how often those highly ranked teams win. We know that picking a number 16 seed to beat a number 1 seed is not statistically a good bet in most pools. In fact, never in history has a 16 seed beaten a 1 seed.

While past performance certainly does not guarantee future success, the data show that seeding is a helpful predictor of success. Top-seeded teams don’t always survive the test to the Final Four, but historically these teams win more than 78 percent of the games they play. A #16 seed has never won a game and the #13-#16 seeds combine to win just slightly more than 10 percent of the games they play.

Selecting teams to win the NCAA tournament is the same as picking investments for your portfolio. The intent is to identify the investments with the greatest likelihood of outperforming the overall market.

The most objective tool I have found to do this is relative strength. Incorporating relative strength into your portfolio analysis will force you to invest in the right areas of the market, (like the Energy sector from 2000 to the middle of 2008). But possibly, and more important, relative strength will force you to get out of investments that aren’t working, (like the Equities market in early 2008).

So don’t scoff at the person who fills out brackets based entirely on seeds. They’re playing the percentages, Whether or not they realize it. This goes a long way to explaining why the winner of the office pool is usually the person who knows little or nothing about basketball. (Chances are, it’s also the person everyone else turns to for help with the photocopier or retrieving voicemail messages).

No matter what method you choose to complete your bracket, enjoy the Tournament. It truly is the Mardi Gras of American sporting events year after year.

###

Roger S. Balser is the Managing Partner and Chief Investment Officer of Balser Wealth Management, LLC with more than twenty-five years experience. He works one on one with individuals to help regain control of their investment and retirement portfolio(s). Roger’s addressed a host of professional organizations nationwide and weekly give his two cents on the popular “Two-Minute-Tuesday.” If you have any questions about the particulars of your investment portfolio or retirement plan at work, or would like to discuss potential opportunities within the equity market, please contact Balser Wealth Management, LLC, 36873 Harriman Trail Avon, OH 44011, 440-610-3012, roger@balserwealth.com

Roger S. Balser

Ways to Sabotage Your Portfolio

Psst! Want to lose a lot of money?

While there are no foolproof ways to accurately predict the market, there are several foolish ways in which investors can successfully subvert their portfolios and reap big losses. Here are several examples of how unknowing investors can unwittingly sabotage an investment portfolio.

Neglect the Driving Force Behind Any Business: Supply and Demand

Business success (or lack thereof) boils down to two simple words — Supply and Demand. It’s that simple. It doesn’t matter whether you are talking about the oil market, iPods, golf courses, lemonade stands, or the stock market. Simply put, if there are more buyers in a particular security than there are sellers willing to sell, the price will rise. Conversely, if there are more sellers in a particular security than there are buyers willing to buy, then the price will decline. If buying and selling are equal, the price will remain the same. This is the irrefutable law of supply and demand. The same reasons that cause price fluctuations in produce such as potatoes, corn and asparagus cause price fluctuations on Wall Street. The “Point & Figure” methodology I use is just a logical, sensible organized way of recording that supply and demand relationship. It simply arranges the information in a way that makes sense to me. A telephone number is no different; it is just a way of organizing 10 digits in a way that makes sense to us and the AT&T network. A Point & Figure chart is just a way of organizing a series of prices into a pattern that makes more sense.

Attempting to Play the Game Without Knowing What Team is on the Field

Think about your favorite football team for a moment. If they play offense 100 percent of the time, they are going to be marginal at best and at times downright awful. There’s a time to have the offensive team on the field and a time to have the defensive team on the field. The problem with most investors is they don’t know what stadium the game is being played in much less which team has the ball. Before deciding on any strategy, you must know whether you’re in a wealth accumulation mode or a wealth preservation mode.

Arrogance. The Market is Easy to Figure Out — But Only if You Listen

The market teaches humility. The sooner you acknowledge the fact the market is going to do what it’s going to do, and forget about trying to tell the market why it must do something because the economic numbers came out a certain way, the better off you’ll be. A quick look at the sector bell curve from different time periods can provide you a clear picture of what the risk in the overall market is. In October 2011 the world was facing down a financial crisis in Europe, Occupy Wall Street protesters, and a war in Libya, none of which were positive indicators. It was a hard time to invest, but if you stopped coming up with reasons why the market shouldn’t do this or shouldn’t do that long enough, you could have heard clearly what the market was telling you. It was saying risk was low and money should be put to work. Case in point: The S&P 500 gained more than 17 percent from October 10, 2011 through March 29, 2012.

Making Stock Selection Decisions on Fundamentals Alone

General Electric (GE) is a company that has their hands into everything, from industrial manufacturing, aircraft engines, nuclear power, loans (GE Capital), land management/acquisition, and more. GE basically has a hand in the honeypot of pretty much everything you can dream of. For a while, the stock price tracked the earnings in a general sense, but then in the year 2000 that correlation ended. The earnings continued to head higher, and meanwhile the stock price was cut in half. As of this writing, GE is still more than 65 percent below its high, while earnings have more than doubled.

Buying a Stock Simply Because It is a Good “Value”

There are two problems with buying on value alone. First, the stock can remain a great value and not move. Second, the stock can become an even better value by continuing to move lower. I believe it’s great to buy value stocks, but only when demand starts to come back to the stock. The pharmaceutical companies Eli Lilly (LLY) and Bristol Myers Squibb (BMY) are stocks that many regarded as good value investments before their sheer sell-offs in 2000. They have become even better “values” as they have continued their downward decline.

Being Afraid to Buy Strong Stocks

Sir Isaac Newton said, “Things in motion tend to stay in motion.” There’s an old stock market cliché that says the first stocks to double in a bull market usually double again. This mentality would have kept you out of Apple (APPL), which was up 201 percent between January 2009 and August 2010, and rose another 137 percent by the end of March 2012. It also would have kept you out of W.R. Grace (GRA), which was up 201 percent between January 2009 and August 2010, and up another 137 percent by March 2012. These are only two examples, but there are many others.

More important than how much the stock is up is its supply and demand relationship. By assessing the Point and Figure chart, you can gain insight into this relationship to gauge whether or not the stock is likely to move higher. Stocks that double can easily double again. Don’t miss out on these great opportunities.

Selling a Stock Because It’s Gone Up

Have you ever sold a stock for a small profit only to watch it continue to move higher and higher? It’s upsetting for any of us to remember those piles of money we let get away, but we have to keep in mind that in the long run it’s the size of your winners that counts, not how many winners you can find. For that reason, you want to become very judicious at managing the position. When you have a stock with strong technical qualities, prune the position, but hold the core position. There are a number of strategies to retain the core position, from just holding the stock, to using the options market. Relative Strength is one of the strategies I use. It’s a great tool for keeping at least one leg in a position for long-term growth.

Holding on to Losing Stocks and Hoping They Come Back

Often referred to as “buy and hope” or letting your losses run, many people are still holding stocks from the go-go years that have no possible chance of ever regaining their stardom. Just as the size of your winners matters, the size of your losers counts just as much or more. You need to make sure that you always come back with the ability to play another day. If you have a stock that declines 50 percent, then you’ve backed yourself into a corner because now you need that stock to double just to get back to even. It’s a fourth- down-and-forever situation, which is not desirable for any coach.

For example, the person who bought Cisco Systems (CSCO) at $82 in 2000 is reeling from its current price of about $20. That stock would have to quadruple just to get back to even! If you remember the early 2000s, investors were not beginning to sell stocks, this is when the average investor had just gone on margin to buy more. Will energy and gold become the next technology bubble? I don’t know. What I do know is the charts will give us sell points along the way and keep us from holding positions into the abyss.

Making Moves Based on a Magazine Cover

Following the hot news that appears on a magazine cover or a TV show is a shortcut to the poor house. Why would you follow the advice of an editor who has just moved from the society pages to the business section?

For instance, in October 2004 The Economist came out with a cover that said, “Scares Ahead for the World Economy” which would have made you think investing globally was not the correct play. Instead the International Markets’ returns dwarfed the U.S. from 2004 until late 2011. Their October 15th cover headlined, “Nowhere to hide. Investors have had a dreadful time in the recent past. The immediate future looks pretty rotten, too.” Since the then the S&P has gained 15 percent through the end of March 2012.

By staying far away from these money-draining traps, adhering to your pre-determined objectives, incorporating reasonable thought processes and using sound judgment, you can easily safeguard your investment portfolio and eliminate self-imposed losses.

###

Roger S. Balser is the Managing Partner and Chief Investment Officer of Balser Wealth Management, LLC with more than twenty-five years experience. He works one on one with individuals to help regain control of their investment and retirement portfolio(s). Roger’s addressed a host of professional organizations nationwide and weekly give his two cents on the popular “Two-Minute-Tuesday.” If you have any questions about the particulars of your investment portfolio or retirement plan at work, or would like to discuss potential opportunities within the equity market, please contact Balser Wealth Management, LLC, 36873 Harriman Trail Avon, OH 44011, 440-610-3012, roger@balserwealth.com, www.balserwealth.com

Pearls of Market Wisdom From Savvy Investors

There is an old saying that children don’t come with instructions. Instead, we rely on the wisdom and knowledge we’ve gleaned over the years to teach our children what they need to create a happy and fulfilling life. So where does that wisdom come from? It comes from years of personal experiences and the experiences of our friends and loved ones.

Just as we’ve learned our lessons on how to raise children, we can learn some important lessons from savvy investors on how to succeed in the market. So without further ado, I bring you my “Ten Pearls of Market Wisdom from Saccy Investors.

2012 July

The Silver Bullet of Investment Success

The Silver Bullet of Investment Success

You know that sinking feeling you get in the pit of your stomach when you receive your investment statement in the mailbox. You worry that it might contain disturbing news? You anxiously let the package rest on the counter wishing it would just vanish. Finally you rip the envelope open and there it is in black and white.

“Statement-shock!”

Instead of that monthly statement shock, wouldn’t it be great to discover a “silver bullet?” That one piece of information that can help you improve the performance of your investment and retirement portfolios.

I’m happy to share with you that I have discovered it! In late 1999, I stumbled upon it in the most unlikely place you would expect to find such information: while working at a large full service brokerage firm. The silver bullet for investment success is “relative strength.”

WHAT IS RELATIVE STRENGTH?

Relative strength provides you a visual picture that identifies IF you should own an investment and WHEN you should own it. According to Tom Dorsey of Dorsey Wright and Associates, “relative strength is a comparison of price trend between one stock verses another stock or an index. I think of relative strength as an arm wrestling contest. Take two middle weights whose physical statistics stack up evenly. Viewing both individuals would not, in this example, suggest one was stronger than the other. That is until they arm wrestle. In this contest person A easily beats person B. If A and B were stocks, the result of this contest would suggest you buy A over B. Nothing says in the long term that B cannot get a gym membership and ultimately build more strength than A. The point is we can easily check the relative strength any second we wish by clicking the mouse of a computer that is programmed to do the simple calculation.”

ONE IMPORTANT CALCULATION

One important relative strength calculation I use in the portfolio decision making process is the comparison between the Standard and Poor’s 500 (S&P 500) and the Money Market. The Money Market is a benchmark for cash and the S&P 500 is generally acknowledged as the yardstick for the stock market. Generally, these two investments are negatively correlated. When one goes up in price, the other goes down. This calculation has only changed four times in the past 11 years.

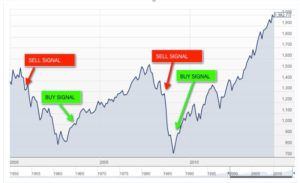

The chart below is a depiction of the S&P 500 with the four changes and the relationship change. A buy signal indicates the relationship between the Money Market and S&P 500, favors owning stocks. (An offensive position.) A sell signal suggests the Money Market is favored. (A defensive position.) This relationship is going to be after the peak or valley of a major market cycle.

WHEN REALTIVE STRENGTH TALKS, LISTEN

Let’s do some quick math with a hypothetical $100,000 investment. If you used the above S&P 500/Money Market relationship as your guide on November 30, 2000 your last line of defense was breached. You sold your stocks or stock mutual funds and waited out the downturn by parking yourself in the Money Market. You would have been pleasantly sitting in cash and avoided 9/11 and the mayhem in the market that followed.

On May 30, 2003 the relative strength indicator advised you it was safe to go back in the market and where you remained until July 7, 2008. Your $100,000 has grown to $137,675. At this time the relative strength indicator pivots to a defensive posture and you withdraw to the sanctuary of the Money Market. Once again sidestepping the worldwide market meltdown, where some investors lost 50% or more. After the bottom of the market in March of 2009, the indicator (July 20, 2009) once again changes posture and you redeploy your assets into the market.

As of September 23,2014 just by reacting to the relative strength relationship of stocks to cash your nest egg today is valued at $286,997, a gain of over 261%.

In contrast if you applied the “buy and hold” philosophy most advisors advocate, your nest egg is approximately $150,780, a gain of more than 50%, excluding inflation. If you hit the panic button in either 2002 or 2008 without a blueprint to return to the market, you are way behind.

TIP OF THE ICEBERG

The relative strength comparison between the Standard and Poor’s 500 and the Money Market is

only the tip of the iceberg with respect how you can use the “silver bullet” of relative strength in your investment decision-making process.

If you used relative strength to compare asset classes you would have participated in the rise of commodities or the blockbuster growth of the emerging markets or even held fixed income in 2002 and 2008.

In summary, relative strength can help you improve performance, preserve capital and eliminate the pain, frustration and emotionality of investing. Choose to ignore it at your own peril.

###

Roger S. Balser is the Managing Partner and Chief Investment Officer of Balser Wealth Management, LLC with more than twenty-five years experience. He works one on one with individuals to help regain control of their investment and retirement portfolio(s). Roger’s addressed a host of professional organizations nationwide and weekly give his two cents on the popular “Two-Minute-Tuesday.” If you have any questions about the particulars of your investment portfolio or retirement plan at work, or would like to discuss potential opportunities within the equity market, please contact Balser Wealth Management, LLC, 36873 Harriman Trail Avon, OH 44011, 440-610-3012, roger@balserwealth.com, www.balserwealth.com

Roger S. Balser